I had a recent conversation with a colleague and was blown away when he said he had no idea how much money he spent in a week. Back info he is a single male. I declared, “But you must know!” He said no he would have no idea. He just takes his pay check pays bills and spends the rest.

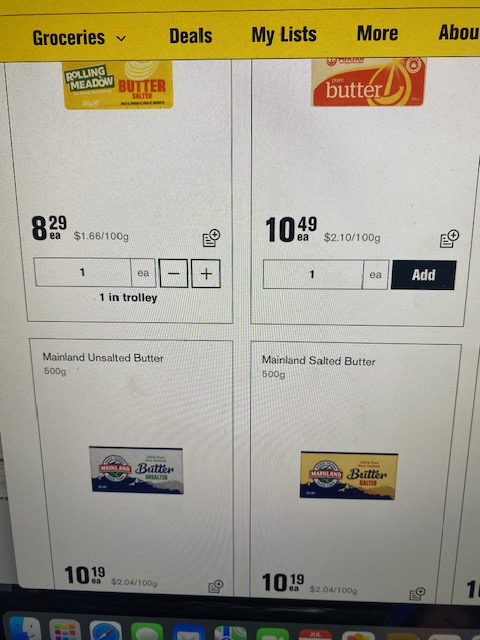

This alone nearly gave me heart palpitations. I have a budget. To be honest it is one of the things I really enjoy doing each week(call me geeky). Some weeks it’s frustrating but most weeks I love seeing just how far we can stretch the money. We don’t live week to week, nor month to month. I budget based on annual expenses + 5% and I review this every monthish based on what we have coming up. We have sinking funds an emergency account and additional savings accounts. We are not wealthy but we are comfortable.

I have trouble sleeping if I feel as though we are not prepared for the unknown. So it totally blew me away that he was so blase about how he spent his money. I think the frustration came from the fact that he often complains he will never be wealthy or have anything. I felt like shaking him and saying, “Do you realise how much you are wasting each week?” His opinion, life’s short it’s not worth worrying about.

Luckily his finances are none of my business nor worth me stressing over but it did leave me thinking. What is the difference between him and I? Is it education? I often think about the legacy that we will leave for our children and Grandchildren but he has a child and Grandchild so it isn’t that.

I know that I have always been interested in budgeting and how I can make my money grow with little effort on my part and because of this interest I have educated myself and spent lots of time reading up on these things.

I feel as though a budget is a necessity and should be it’s own subject at school for at least one Semester. We wouldn’t have savings without a budget as it would all just disappear into the oblivion that is life.

Do you budget or do you wing it ?